Table of Contents

ToggleMoney Lending Apps are changing how people borrow money and manage their personal finances. One popular example is Brigit, a smart financial technology app that gives users small cash advances and helps them avoid overdraft fees.

If you’re thinking about building a similar app, the first question you may ask is: How much does it cost to build money lending app like Brigit?

This guide breaks down how these apps work, why they’re growing in demand, and what it takes to build an advanced cash app like Brigit.

Understanding Money Lending Apps Like Brigit

Money Lending Apps like Brigit are simple tools that help people borrow money quickly. They also help users track their spending and improve their credit scores.

Brigit, for example, is a custom mobile app development success story. It uses smart AI technology to study your finances and give you money before payday.

Here are some important features in Brigit:

- Instant cash advance (up to $250)

- Automatic overdraft protection

- Budgeting tools and financial alerts

- Credit score building support

- AI-based financial tracking

- Subscription for extra features

To build a money lending app like Brigit, you’ll need a strong and secure system, a smooth design, and clear features that people trust and understand.

How Does a Cash App Like Brigit Work?

Brigit works in a very smart and simple way. It looks at your income, spending, and bank account to decide if you can get a cash advance. If your balance is low, the app can send you money automatically so you don’t go into overdraft.

Here’s how it works step-by-step:

- User Signs Up: Connects their bank account and gives permission for the app to check finances.

- AI Scans Finances: The app uses AI to understand spending habits and income patterns.

- Cash Advance is Offered: If the user is eligible, the app gives a small advance (up to $250).

- Budgeting Tools Help: The app sends alerts, tips, and insights to improve spending.

- Credit Building: Some plans offer ways to improve credit scores through small loans.

Thanks to its smart tech and helpful tools, Brigit has become one of the most popular apps in the financial technology app world.

Why Invest in Developing an App Like Brigit?

Now is a great time to invest in money lending app development. The global fintech market is growing fast. In fact, it’s expected to reach $608.35 billion by 2029.

Here’s why building an app like Brigit is a smart idea:

- More People Use Phones for Banking: Many people want apps to manage their money.

- High Demand for Quick Cash: People want fast access to money before payday.

- Reach More Users: Apps like Brigit help people with no access to banks.

- Support the Gig Economy: Freelancers and gig workers often need small cash boosts.

- Offer Value and Trust: By focusing on credit building and financial health, your app can stand out.

- Partner with Experts: A trusted app development solution company can help you create a secure and easy-to-use app.

Developing an app like Brigit is more than just creating software, it’s about giving people the tools they need to stay financially healthy.

Also read: Implementing AI in Banking and Fintech Application

Why Is It Important to Estimate the Cost of Money Lending App Development?

Knowing the cost to build money lending app like Brigit is very important before starting the project. It helps you plan wisely and avoid surprises.

1. Better Budget Planning

When you know the cost, you can set a clear budget. This helps you spend money where it matters most and avoid wasting funds. You can also work with a top mobile app development company to manage your budget from start to finish.

2. Choosing the Right Features

Cost estimation helps you pick the features your app really needs. Instead of adding everything at once, you can focus on the most useful features first and plan for extra ones later.

3. Stay Ahead of Competition

Having a solid budget makes your app more competitive. You can launch faster and smarter, which helps you stay ahead in the fast-growing money lending apps market.

4. Planning for the Future

Understanding the full cost also helps you think ahead. You’ll be ready for future updates, new features, and growth when your app becomes more popular.

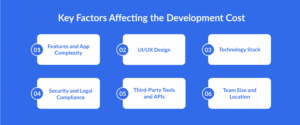

Key Factors Affecting the Development Cost

The cost to build money lending app like Brigit depends on many things. Here are the top factors that can change how much you spend:

1. Features and App Complexity

The more features your app has, the more it costs. A simple app with basic tools is cheaper. But if you want smart AI, credit checks, and more, the price goes up.

2. UI/UX Design

A good-looking and easy-to-use app brings more users. High-quality custom mobile app development with clean design takes more time and money, but it’s worth it.

3. Technology Stack

The tools and tech used (like cloud servers or AI) can change the cost. Choosing between native or cross-platform development also matters.

4. Security and Legal Compliance

Your app will handle personal financial data. So, you must follow laws like GDPR and PCI DSS. This means extra work to make sure the app is safe and legal.

5. Third-Party Tools and APIs

If your app connects to services like PayPal, credit bureaus, or banks, you’ll need third-party APIs. These can come with extra costs for licenses and setup.

6. Team Size and Location

Developers in the US or Europe may cost more. Working with skilled teams from other regions can help you save without losing quality.

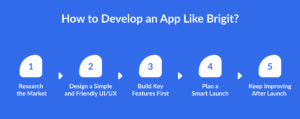

How to Develop an App Like Brigit?

Developing a Fintech app like Brigit isn’t easy or just about writing code. It’s about solving real problems for users who need instant money help and better control over their finances.

Here’s a step-by-step guide to help you build an advance cash app like Brigit:

1. Research the Market

Start by studying other money lending apps like EarnIn, Empower, EveryDollar, and MyFawry. See what features they offer, what users like, and where they fall short. This research helps you understand your audience and gives you ideas to make your app stand out in a busy market.

2. Design a Simple and Friendly UI/UX

Make sure your app is simple for everyone to use. Use clear layouts, easy buttons, and labels that are easy to understand. The goal is to help users find things quickly without getting confused. A user-friendly design builds trust and makes people want to use the app again.

3. Build Key Features First

Focus on adding the most important features first:

- User Sign-Up and KYC: Allow users to register easily and verify their identity for security.

- Cash Advance System: Let users get instant money before payday to avoid financial stress.

- Budget Tracking Tools: Help users see how much they spend and where they can save.

- Credit Score Monitoring: Let users track and improve their credit over time.

Start simple and improve step by step using agile development to keep adding value based on feedback.

4. Plan a Smart Launch

Before launching, test the app with a small group of real users. Fix bugs, polish features, and gather feedback. Then, use App Store Optimization (ASO) to help more people find your app through search keywords, screenshots, and a strong app description.

5. Keep Improving After Launch

Once your app is live, keep making it better. Add new features like loan history, savings tools, or custom alerts based on what users want. Regular updates, strong security, and customer support help build trust and keep users happy.

Technology Stack used to Build a Cash App

To build advanced cash app platforms like Brigit, you need strong technology. Here’s a simple list of tools used:

1. Backend (The engine of the app)

- Python / Node.js / Java (Spring Boot) – These help your app run smoothly and handle data.

- Ruby on Rails – Useful for building secure web-based parts of the app.

2. Data Processing

- WebSockets, Apache Kafka, RabbitMQ – These tools help send and receive real-time data fast.

3. Front-End Development (What users see)

- Swift (iOS), Kotlin (Android) – For native mobile apps.

- React Native – For cross-platform apps that work on both Android and iOS.

4. DevOps (App maintenance & scaling)

- Docker, Kubernetes, Jenkins – These help manage, test, and deploy your app safely and quickly.

This stack gives you everything you need to create a high-performance, secure, and user-friendly financial technology app.

Also Read: Cost to Develop Buy Now Pay Later App like Afterpay

Why Choose Developer Bazaar Technologies for Your Money Lending App Development?

If you’re looking to build an advanced cash app that’s fast, safe, and smart, Developer Bazaar Technologies is the right partner for you. We have deep experience in money lending app development, and we make sure every app is built to perform well, stay secure, and grow with your business.

Here’s why clients trust us:

- Tailored Solutions for Your Business: We don’t believe in one-size-fits-all. Our team creates custom mobile app development plans that match your goals, target audience, and lending process.

- High Security and Compliance: Security is a top most important while developing a Fintech App. We follow global rules like PCI DSS and GDPR to keep your users’ financial data safe and your app legally compliant.

- Scalable Architecture: Developer Bazaar Technologies build apps that boost your business goals. You can start small and add new features anytime, without rebuilding everything from scratch.

- User-Friendly UI/UX Design: Our designers focus on creating simple, clean, and beautiful screens. Your users will find it easy to use the app and stay engaged.

- Cost-Effective and On-Time Delivery: We deliver high-quality apps within your budget and deadlines. We help you lower the cost to build money lending app like Brigit without cutting corners.

Conclusion

Developing a powerful and secure financial technology app like Brigit is a smart business move. While the development cost may range from $40,000 to $80,000, the final budget depends on the features, design, and tech stack you choose. The development cost of your app will increase if your app is more complex.

But remember, a well-built app gives long-term returns. With smart tools like budgeting, instant loans, and credit tracking, you can help users manage their money better.

Also, your business stays ahead of the competition in the fast-growing money lending apps market.

To get the best results, work with a reliable Fintech app development services provider Developer Bazaar Technologies. Our team will handle everything from planning to launch while keeping costs low and quality high.

FAQs

Q1: How long does it take to develop a money lending app?

A: It usually takes between 3 to 9 months, depending on your app’s complexity and the features you want. A basic app takes less time, while advanced apps with AI and credit checks take longer.

Q2: What are the must-have features in a money lending app?

A: Important features include user login, loan application, AI-based credit scoring, payment systems, and data protection. More features mean more value for users—but also a higher budget.

Q3: Can I start with an MVP and scale later?

A: Yes! You can start with an MVP (Minimum Viable Product) to test your idea. This helps save money in the beginning and lets you improve the app later based on real user feedback.

Q4: How can I monetize my money lending app?

A: You can earn through loan interest, transaction charges, premium features, and third-party tools. Many apps also make money by offering subscriptions or in-app upgrades.

Q5: Is it necessary to comply with financial regulations?

A: Yes, absolutely. Your app must follow financial rules and safety standards like GDPR, PCI DSS, and KYC. This keeps your app legal and builds trust with users.